Post

Proper Planning Brightens the Future of ...

Traditionally Indians are bound to the practice of Savings. There is a deep-rooted sense of managing the income by spending less and postponing the luxuries of life. But this ‘saving culture’ has come under threat. The change in mindset is very evident with the youth and the EMI fixated middle-aged salary earners, who are impressed with the easy spending consumer culture of the west.

But the recent global pandemic has exposed the virtues of savings. Even after pay cuts people have realised the power of saving money and planning for the future. Today, those who saved and invested wisely are secure in their lives and livelihood. Their past course of action brings to light the quintessential question running in everyone’s mind “How much to save to plan a secure future”.

The truth be told there is no one size fit all planning strategy for savings. But a general thumb rule to start saving is to start analyzing spending.

Income - Expenses = Savings

Spending before saving is a very wrong approach which brings uncertainty to the saving pattern. This leftover savings attitude leads to seldom saving money and doesn’t transpire to a secure or wealthy future.

Income + Loans = Expenses

People with good income have fallen pray to the crime of overburdening themselves with loans. Their short-sightedness or naive nature sucks them into additional loans to meet the regular expenses. Only divine intervention can rescue them from such erroneous financial moves.

Income - Savings = Expenses

The correct approach for wealth management is to make savings a constant and premiere. This approach develops the disciple to save first before spending. Thereby not only mastering income management, but also expense management.

How much should be Saved or Invested?

The recommendation to allocate for the savings or investment plan is to get a clear understanding on the short, medium and long term goals. The start can be as modest as 10% of the net monthly income and increase it to 30%.

Short term Goals

The goals will materialize in the immediate future with an approximate timeframe of 18 month or about. These goals will comprise of:

1. Planning for a vacation

2. Purchase of a car

Medium Term Goals

These are intermediate financial goals with a term of 60 months.

1. Creating emergency fund

2. Purchase of a property

Long Term Goals

These are very important goals with 10 years or above.

1. Investing for kids higher education

2. Retirement Planning for self and spouse

3. Creating a corpus for kids grand auspicious wedding

4. Investing to create a huge financial asset

Fixed Monthly Expenses

The bills and expenses that don’t vary much and require a commitment to paying them on a monthly basis. This should not exceed 30% of the monthly income. These includes rent, groceries,fees, utilities and eats out with friends and family.

Loans and EMI's

The combined EMIs should never exceed 40% of the total monthly earnings to avoid any kind of derailments from the other goals. It is here that the temptation to pay in instalments hampers the joys of the present day. In most cases bankers don’t lend more than 50% of your monthly net income as EMI.

The path to a bright and secure future depends on many small correct choices made in the present for saving and investing. There are always turns off uncertainties but that should never stop the process of preparedness. And its never too late to start the journey of planning.

...

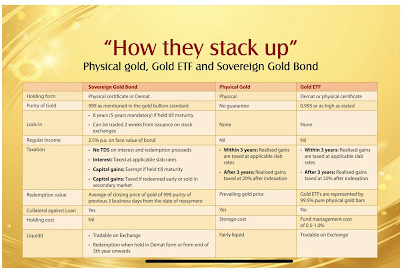

Sovereign Gold Bond...

1. What is Sovereign Gold Bond (SGB)? Who is the issuer?

SGBs are government securities denominated in grams of gold. They are substitutes for holding physical gold. Investors have to pay the issue price in cash and the bonds will be redeemed in cash on maturity. The Bond is issued by Reserve Bank on behalf of Government of India.

2. Why should I buy SGB rather than physical gold? What are the benefits?

The quantity of gold for which the investor pays is protected, since he receives the ongoing market price at the time of redemption/ premature redemption. The SGB offers a superior alternative to holding gold in physical form. The risks and costs of storage are eliminated. Investors are assured of the market value of gold at the time of maturity and periodical interest. SGB is free from issues like making charges and purity in the case of gold in jewellery form. The bonds are held in the books of the RBI or in demat form eliminating risk of loss of scrip etc.

3. Are there any risks in investing in SGBs?

There may be a risk of capital loss if the market price of gold declines. However, the investor does not lose in terms of the units of gold which he has paid for.

4. Who is eligible to invest in the SGBs?

Persons resident in India as defined under Foreign Exchange Management Act, 1999 are eligible to invest in SGB. Eligible investors include individuals, HUFs, trusts, universities and charitable institutions. Individual investors with subsequent change in residential status from resident to non-resident may continue to hold SGB till early redemption/maturity.

5. Whether joint holding will be allowed?

Yes, joint holding is allowed.

6. Can a Minor invest in SGB?

Yes. The application on behalf of the minor has to be made by his/her guardian.

7. Where can investors get the application form?

The application form will be provided by the issuing banks/SHCIL offices/designated Post Offices/agents. It can also be downloaded from the RBI’s website. Banks may also provide online application facility.

8. What are the Know-Your-Customer (KYC) norms?

Every application must be accompanied by the ‘PAN Number’ issued by the Income Tax Department to the investor(s).

9. Can an investor hold more than one investor ID for subscribing to the Sovereign Gold Bond?

No. An investor can have only one unique investor Id linked to any of the prescribed identification documents. The unique investor ID is to be used for all the subsequent investments in the scheme. For holding securities in dematerialized form, quoting of PAN in the application form is mandatory.

10. What is the minimum and maximum limit for investment?

The Bonds are issued in denominations of one gram of gold and in multiples thereof. Minimum investment in the Bond shall be one gram with a maximum limit of subscription of 4 kg for individuals, 4 kg for Hindu Undivided Family (HUF) and 20 kg for trusts and similar entities notified by the government from time to time per fiscal year (April – March). In case of joint holding, the limit applies to the first applicant. The annual ceiling will include bonds subscribed under different tranches during initial issuance by Government and those purchased from the secondary market. The ceiling on investment will not include the holdings as collateral by banks and other Financial Institutions.

11. Can each member of my family buy 4Kg in their own name?

Yes, each family member can buy the bonds in his/her own name if they satisfy the eligibility criteria as defined at Q No.4.

12. Can an investor/trust buy 4 Kg/20 Kg worth of SGB every year?

Yes. An investor/trust can buy 4 Kg/20 Kg worth of gold every year as the ceiling has been fixed on a fiscal year (April-March) basis.

13. Is the maximum limit of 4 Kg applicable in case of joint holding?

The maximum limit will be applicable to the first applicant in case of a joint holding for that specific application.

14. What is the rate of interest and how will the interest be paid?

The Bonds bear interest at the rate of 2.50 per cent (fixed rate) per annum on the amount of initial investment. Interest will be credited semi-annually to the bank account of the investor and the last interest will be payable on maturity along with the principal.

15. Who are the authorized agencies selling the SGBs?

Bonds are sold through offices or branches of Nationalised Banks, Scheduled Private Banks, Scheduled Foreign Banks, designated Post Offices, Stock Holding Corporation of India Ltd. (SHCIL) and the authorised stock exchanges either directly or through their agents.

16. If I apply, am I assured of allotment?

If the customer meets the eligibility criteria, produces a valid identification document and remits the application money on time, he/she will receive the allotment.

17. When will the customers be issued Holding Certificate?

The customers will be issued Certificate of Holding on the date of issuance of the SGB. Certificate of Holding can be collected from the issuing banks/SHCIL offices/Post Offices/Designated stock exchanges/agents or obtained directly from RBI on email, if email address is provided in the application form.

18. Can I apply online?

Yes. A customer can apply online through the website of the listed scheduled commercial banks. The issue price of the Gold Bonds will be ₹ 50 per gram less than the nominal value to those investors applying online and the payment against the application is made through digital mode.

19. At what price the bonds are sold?

The nominal value of Gold Bonds shall be in Indian Rupees fixed on the basis of simple average of closing price of gold of 999 purity, published by the India Bullion and Jewelers Association Limited, for the last 3 business days of the week preceding the subscription period.

20. Will RBI publish the rate of gold applicable every day?

The price of gold for the relevant tranche will be published on RBI website two days before the issue opens.

21. What will I get on redemption?

On maturity, the Gold Bonds shall be redeemed in Indian Rupees and the redemption price shall be based on simple average of closing price of gold of 999 purity of previous 3 business days from the date of repayment, published by the India Bullion and Jewelers Association Limited.

22. How will I get the redemption amount?

Both interest and redemption proceeds will be credited to the bank account furnished by the customer at the time of buying the bond.

23. What are the procedures involved during redemption?

The investor will be advised one month before maturity regarding the ensuing maturity of the bond.

On the date of maturity, the maturity proceeds will be credited to the bank account as per the details on record.

In case there are changes in any details, such as, account number, email ids, then the investor must intimate the bank/SHCIL/PO promptly.

24. Can I encash the bond anytime I want? Is premature redemption allowed?

Though the tenor of the bond is 8 years, early encashment/redemption of the bond is allowed after fifth year from the date of issue on coupon payment dates. The bond will be tradable on Exchanges, if held in demat form. It can also be transferred to any other eligible investor.

25. What do I have to do if I want to exit my investment?

In case of premature redemption, investors can approach the concerned bank/SHCIL offices/Post Office/agent thirty days before the coupon payment date. Request for premature redemption can only be entertained if the investor approaches the concerned bank/post office at least one day before the coupon payment date. The proceeds will be credited to the customer’s bank account provided at the time of applying for the bond.

26. Can I gift the bonds to a relative or friend on some occasion?

The bond can be gifted/transferable to a relative/friend/anybody who fulfills the eligibility criteria (as mentioned at Q.no. 4). The Bonds shall be transferable in accordance with the provisions of the Government Securities Act 2006 and the Government Securities Regulations 2007 before maturity by execution of an instrument of transfer which is available with the issuing agents.

27. Can I use these securities as collateral for loans?

Yes, these securities are eligible to be used as collateral for loans from banks, financial Institutions and Non-Banking Financial Companies (NBFC). The Loan to Value ratio will be the same as applicable to ordinary gold loan prescribed by RBI from time to time. Granting loan against SGBs would be subject to decision of the bank/financing agency, and cannot be inferred as a matter of right.

28. What are the tax implications on i) interest and ii) capital gain?

Interest on the Bonds will be taxable as per the provisions of the Income-tax Act, 1961 (43 of 1961). The capital gains tax arising on redemption of SGB to an individual has been exempted. The indexation benefits will be provided to long terms capital gains arising to any person on transfer of bond.

29. Is tax deducted at source (TDS) applicable on the bond?

TDS is not applicable on the bond. However, it is the responsibility of the bond holder to comply with the tax laws.

30. Who will provide other customer services to the investors after issuance of the bonds?

The issuing banks/SHCIL offices/Post Offices/Designated stock exchanges/agents through which these securities have been purchased will provide other customer services such as change of address, early redemption, nomination, grievance redressal, transfer applications etc.

31. What are the payment options for investing in the Sovereign Gold Bonds?

Payment can be made through cash (upto ₹ 20000)/cheques/demand draft/electronic fund transfer.

32. Whether nomination facility is available for these investments?

Yes, nomination facility is available as per the provisions of the Government Securities Act 2006 and Government Securities Regulations, 2007. A nomination form is available along with Application form. An individual Non - resident Indian may get the security transferred in his name on account of his being a nominee of a deceased investor provided that:

the Non-Resident investor shall need to hold the security till early redemption or till maturity; and

the interest and maturity proceeds of the investment shall not be repatriable.

33. Can I get the bonds in demat form?

Yes. The bonds can be held in demat account. A specific request for the same must be made in the application form itself.

Till the process of dematerialization is completed, the bonds will be held in RBI’s books. The facility for conversion to demat will also be available subsequent to allotment of the bond.

34. Can I trade these bonds?

The bonds are tradable from a date to be notified by RBI. (It may be noted that only bonds held in de-mat form with depositories can be traded in stock exchanges) The bonds can also be sold and transferred as per provisions of Government Securities Act, 2006. Partial transfer of bonds is also possible.

35. What is the procedure to be followed in the eventuality of death of an investor?

The nominee/nominees to the bond may approach the respective Receiving Office with their claim. The claim of the nominee/nominees will be recognized in terms of the provision of the Government Securities Act, 2006 read with Chapter III of Government Securities Regulation, 2007. In the absence of nomination, claim of the executors or administrators of the deceased holder or claim of the holder of the succession certificate (issued under Part X of Indian Succession Act) may be submitted to the Receiving Offices/Depository. It may be noted that the above provisions are applicable in the case of a deceased minor investor also. The title of the bond in such cases too will pass to the person fulfilling the criteria laid down in Government Securities Act, 2006 and not necessarily to the Natural Guardian.

36. Can I get part repayment of these bonds at the time of exercising put option?

Yes, part holdings can be redeemed in multiples of one gm.

Sources : Reserve Bank of India

Public Provident Fund should be part of ...

The current situation in the world has got a lot of people looking back and wishing they had saved some money for a rainy day because it’s been a pretty rainy year so far. The ability or the inclination towards saving money isn’t really a quality associated with the current generation of “millennials” who could learn a thing or two from generation X in this regard. Now, this isn’t a post about mutual funds, or stocks, or foreign exchange, but rather about the first, most basic, risk-free, baby-step that you can take right now.

If you’ve ever worked a nine to five, you probably already know what a provident fund or PF is. You suffer a little deduction in your salary every month in order to ensure you get a decent chunk of cash when you decide to quit or retire. The public provident fund is similar in the sense that it’s guaranteed by the central government and there’s no way you can lose money on it. The similarities end there, however, as anyone can open a PPF account and you don’t need to be working for an organization.

All you need to do to open a PPF account is walk into bank or post-office with some basic identification and about Rs.500 or you can do it online.The fact that you not only get 7% interest on your money annually, which is more than any fixed deposit or savings account is going to offer you, but also income tax deductions for the amount invested makes this an attractive investment for your portfolio. Additionally, any interest received is exempt from tax, and so is the entire amount on maturity, making the opportunity cost of not having a PPF quite high.

Now saving money takes discipline, especially with schemes with fixed recurring deposits where you incur penalties for failure to pay on time. The reason we call the PPF a “baby-step,” is because even an individual who lacks discipline can see this one through to the end with relative ease. This is because there’s virtually unlimited flexibility in how much you want to invest every year with the minimum being Rs.500 and the maximum Rs.150,000.

While the choice is yours, that’s a really huge range and it can be difficult to set a target and stick to it when you don’t really have to. That being said,flexibility is always a good thing, especially in current times. The only catch, if we have to call it that, is that this is long term investment and maturity is after fifteen years. While there are ways to pay a penalty and cash out after 6 years, the plus side is that even a court can’t order you to settle a debt through your PPF account, so it’s basically safe even if you go bankrupt.

Eligibility: Resident Indians

Returns : Guaranteed

Lock In : 15 Years

Taxation : Tax Benefit under section 80c

Maturity : Tax Free

Minimum Investment :Rs 500/-

Maximum Investment :Rs. 1,50,000/-

In conclusion, getting a PPF account is an essential to your investment portfolio, especially with the higher than average interest rate, risk-free factor, tax benefits, and super-flexible payment options.

Importance & Methods Followed In Retirem...

While we all have a lot of hopes, dreams, and ambitions growing up, retiring on a quiet beach or in a cozy hill-station is the ultimate happy ending to whatever your life story has been up until now. Unlike in most fairy tales and movies where people grow old and automatically live happily ever after, retirement in real life takes proper planning and a lot of discipline.

Retirement Planning

Keeping in mind the fact that India has no social security schemes or any other kind of government-sponsored elderly care, you’re basically left with three to four choices at best. While option one is to plan and invest for your retirement right now, the alternatives range from compulsory work post the age of 60, depending on your daughter or son, and in extreme circumstances, even living on charity. While the obvious choice here is option one, we have to factor in a number of elements such as your present age, no of years to retire, present income, expenses, and more.

Other variable factors may include family members who are dependent on your income as well as your risk-taking ability with regards to investments. Further complications include life expectancy on the rise due to advancements in medicine, as well as technology, healthcare services, and expenses taking a similar curve. This means that if the plan is to be completely self-reliant, not only do we need to account for a longer period post-retirement, we also need to account for inflation that could easily see expenses go up by 3-4 times exponentially during our retirement phase.

So how do people plan for a dignified and independent retirement while also factoring in the inconsistencies of life? Well, there are two methods followed globally, they are the replacement ratio method and the expense method.

Replacement Ratio Method

The replacement ratio method is quite simple and similar to how a government pension is calculated. For example, a person who is 45 years of age earning five lakhs a month right now, and set to retire in 15 years would earn 10 lakhs a month by the time he is 60. This is calculated keeping in mind a 5% increase in income year on year. Using this replacement ratio method, he can then choose between a replacement income of 50% (5 Lakhs), 75% (7.5 Lakhs), or 100% (10 Lakhs) for the rest of his life.

Expense Method

As the name suggests, the expense method is all about calculating expenses. As a more customized approach that’s tailor-made to each individual, the expense method helps plan for retirement by calculating all the expenses of the entire family while also factoring in future expenses taking inflation into consideration. For example, a person aged 40 with a monthly expenditure of about Rs.1 lakh, would have a monthly expenditure of about Rs. 2.25 lakh by the time he retires based on a 4% inflation, year on year. Similarly, expenses need to be calculated for every year that we’re retired, while accounting for inflation, all the way up to the age of 85, 90, or even 100. The tricky part, and this is where planning comes in, finding the present cost of investment to meet our forecasted future expenses.

As the saying goes, “the early bird gets the worm,” and this is no more evident than in our daily lives commuting to work. It’s when we’re late that we tend to make mistakes, break rules, jump traffic signals, or generally indulge in risky behavior. The same concept applies to retirement planning and it’s when we start investing early that we can afford to reach our targets by predetermined milestones, safely and without taking any risks. Think of your bank balance as correlating to your time left on this earth, if you have enough money left, you have enough time left, and you can even afford to stop and smell the roses.

In conclusion, the benefits of retirement planning are:

1.Dignity post-retirement.

2.Independence, freedom, self-reliance.

3.More options as to where you would like to retire (The Bahamas, Cabo Beach, Bali etc.)

4.The ability to be an asset to your family rather than a liability in your old age.

5.The ability to pay for expensive medical treatments or procedures without help.

6.Peace of mind not only for yourself, but for your spouse and children as well.

7.Last but not least, guaranteed quality of life post-retirement.

With rising inflation, reducing interest rates in our country, and the current situation in the world being the way it is, unless you plan to inherit a fortune or pull off a money heist, it’s time to start planning and investing. Like we mentioned earlier, the replacement ratio method is a great first stepping stone and gives you a good idea of where you’re at and where you need to be. Please remember, keeping a track of your expenses and being aware of how much you need to save is half the battle won, the rest as we already mentioned, is just discipline.